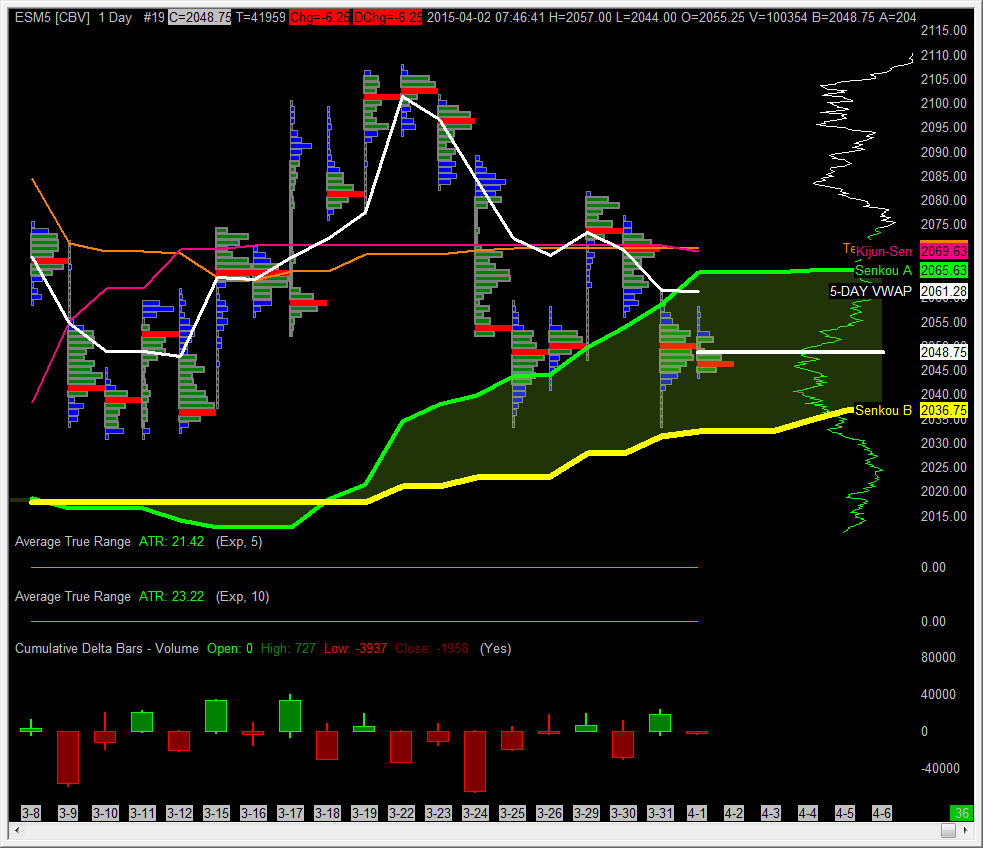

Price tested the 52-Day Midpoint (2036.50) and rallied only to find resistance at Three-Day Central Pivot Zone (2059.50 – 2061.00). These boundaries will mark current price zone from which traders will conduct business. We are anticipating a relatively light volume session today with the shortened trading week in observance of Good Friday (closed).

Today is Cycle Day 1 (CD1): Odds of Decline > 10 = 71%; Odds of Decline > 20 = 41%; Average Range = 18.75; Max Average Range = 22.00; Possible High = 2072.50 based upon average penetration expansion above CD3 high; Possible Low = 2021.50 based upon average violation expansion below CD3 low.

***Note: The odds highlighted are NOT predictions or trade recommendations, rather a guide based upon historical observed occurrences.

Today’s Hypotheses: June (M) Contract

Today’s Hypotheses: June (M) Contract

Scenario 1: IF price can hold above 2040 – 42 zone, THEN odds (65%) favor push higher to 2050 – 2052.25 zone. Above this zone targets 3D CPZ (2059.50 – 2061.00).

Scenario 2: Violation of 2040 – 2042 zone sets up a retest of 2036.50 level…Failure to find responsive buyers targets PL (2033.50)…Further violation of this level measures 2023.

Trade Strategy: Our tactical trade strategy will simply remain unaltered…We’ll be flexible to trade both long and short side from Decision Pivot Levels. Continue to focus on Bull/Bear Stackers and Premium/Discounts. As always, remaining in alignment with dominant intra-day force increases probabilities of producing winning trades.

Stay Focused…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Trading…David

“Knowing is not enough, We must APPLY. Willing is not enough, We must DO. – Bruce Lee