Markets

Jackson Hole Preview: The ‘Powell Put’ Makes a Comeback

As the S&P 500 regains its footing after a volatile few weeks, all eyes are on Federal Reserve Chair Jerome Powell’s upcoming speech at the annual Jackson Hole Economic Symposium.

With inflation cooling to its lowest levels since 2021 and economic data showing resilience, investors are eagerly awaiting clues from the Fed chief on the direction of interest rates, particularly the likelihood of a rate cut at the September FOMC meeting.

Powell is scheduled to deliver his highly anticipated keynote speech at 10:00 AM EST on Friday, at which he is likely to give signals that the central bank is poised to begin gradually cutting rates starting next month. As confidence in a ‘soft landing’ for the economy grows, the big question for investors at this point isn’t whether the Fed will cut rates, but rather by how much and how fast.

As of Wednesday morning, markets were pricing in a 69% chance that the Fed would lower interest rates by 25-basis points by the end of September and a 31% chance of a deeper 50-basis point cut, according to the Investing.com Fed Monitor Tool. A week ago, the odds of a more significant cut were higher, reflecting the evolving expectations surrounding the Fed’s next move.

Source: Investing.com

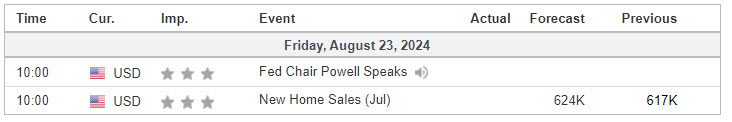

Economic Calendar

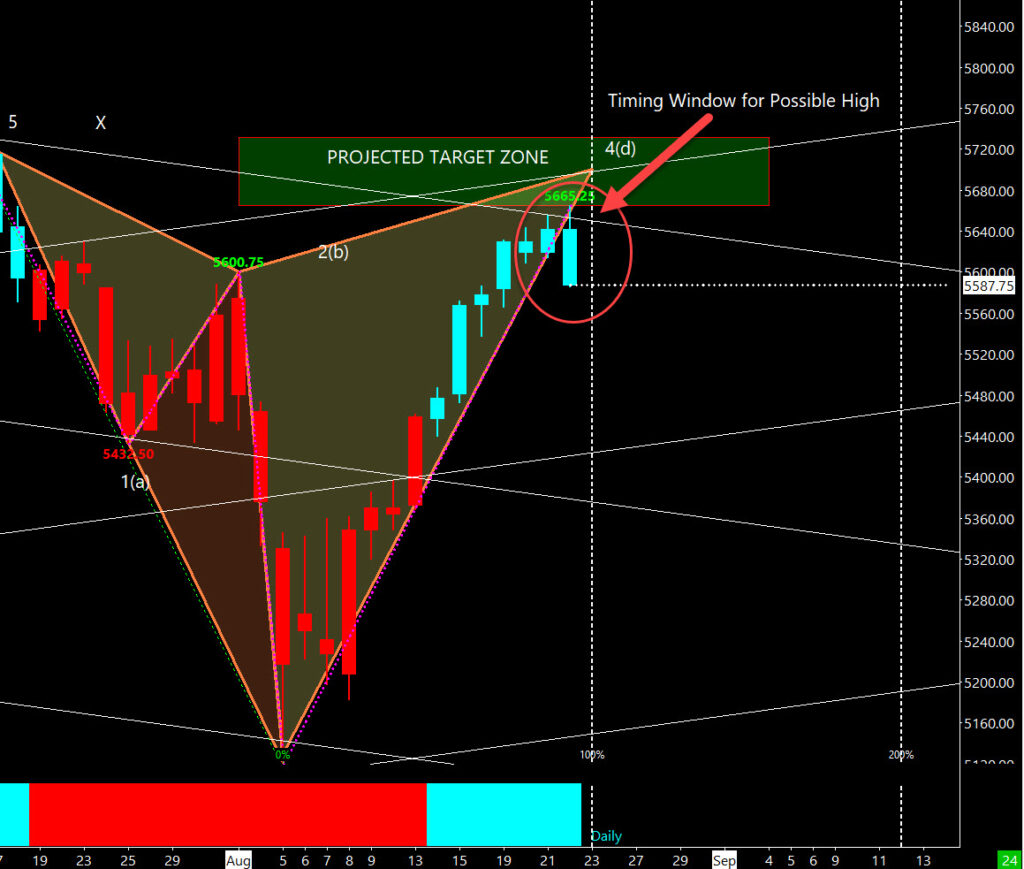

S&P 500

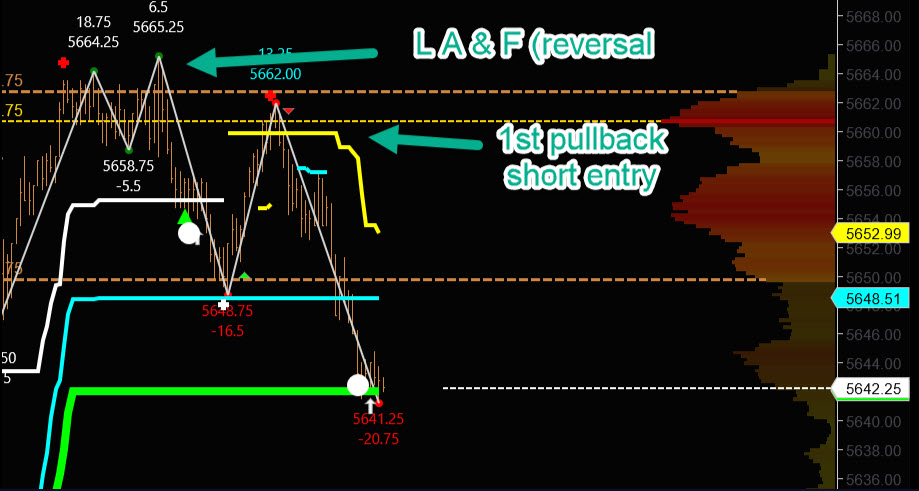

Prior Session was Cycle Day 2: Price briefly extended this cycle’s rally fulfilling upside D-Level Money Box (DLMB) zone as depicted in prior DTS Briefing 8.22.24. Failure to sustain an adequate bid set up the classic “Look Above and Fail (reversal), newly coined “The Whiplash” trade. (see screenshot below) The bull trend as defined by “One Time-Framing” on the daily charts has finally come to an end after nine consecutive up days. Range was 82 handles on 1.328M contracts exchanged.

…Transition from Cycle Day 2 to Cycle Day 3

This leads us into Cycle Day 3: The BIG DAY has arrive with JPOW speaking at JHOLE (see preview above). Price is currently trading below Cycle Day 1 Low (5613.50) with high historical odds (90%) of trading above this level during today’s session. How the market reacts to JPOW will determine if this statistic gets satisfied.

***Anticipate high “snappy/trappy” volatility centered around JPOW speech…Highly unpredictable market reactions and counter-reactions to the counter-reactions. You get the idea… CAPITAL PRESERVATION FRYDAY!

Many levels that we have been citing during the multi-day uptrend now have been violated and will need to be retested/reclaimed to determine the veracity of the these levels for future trade reference. Finally, to close out the week, today August 23rd, 2024 is noted for a possible Price and Time High (see screenshot below)

Know Thy Plan! Our discipline of maintaining positioning that is aligned with market forces continues to serve us well, so stay the course.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 5605, initially targets 5620 – 5630 zone.

Bear Scenario: Price sustains an offer below 5605, initially targets 5585 – 5575 zone.

PVA High Edge = 5633 PVA Low Edge = 5583 Prior POC = 5600

*****The 3 Day Cycle has a 90% probability of fulfilling Positive Cycle Statistics covering 12 years of recorded tracking history.

ES Chart

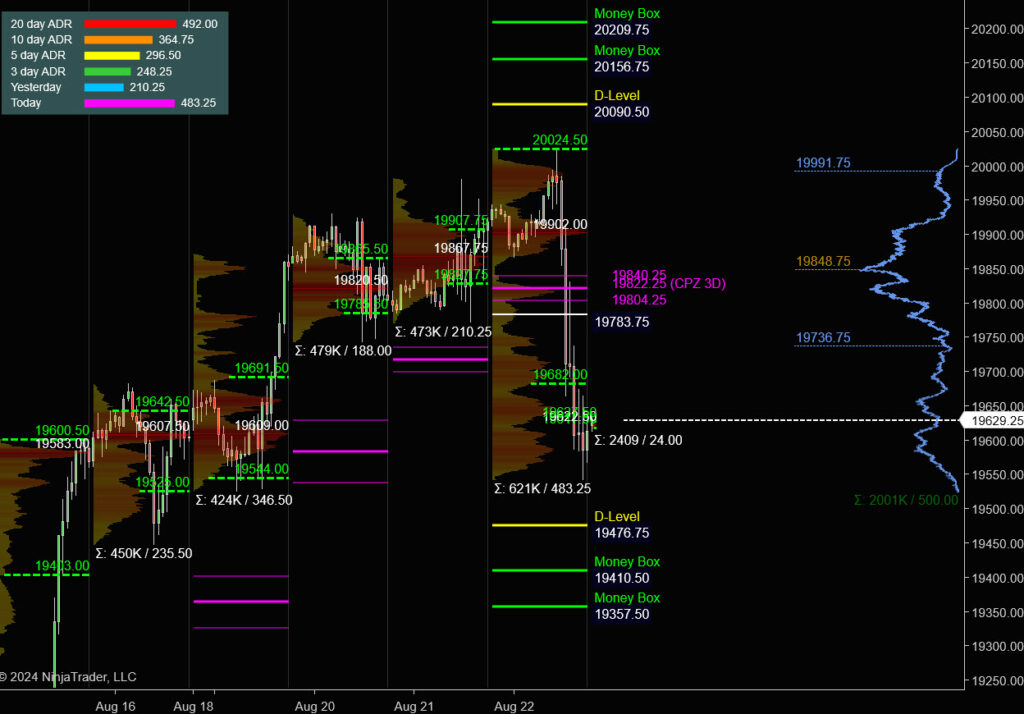

Nasdaq 100 (NQ)

Prior Session was Cycle Day 2: Price briefly extended this cycle’s rally fulfilling upside D-Level Money Box (DLMB) zone as depicted in prior DTS Briefing 8.22.24. The bull trend as defined by “One Time-Framing” on the daily charts has finally come to an end after nine consecutive up days. Range was 483 handles on 621k contracts exchanged.

…Transition from Cycle Day 2 to Cycle Day 3

This leads us into Cycle Day 3: The BIG DAY has arrive with JPOW speaking at JHOLE (see preview above). Price is currently trading below Cycle Day 1 Low (19771.50) with high historical odds (90%) of trading above this level during today’s session. How the market reacts to JPOW will determine if this statistic gets satisfied.

Know Thy Plan! Our discipline of maintaining positioning that is aligned with market forces continues to serve us well, so stay the course.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 19610, initially targets 19715 – 19735 zone.

Bear Scenario: Price sustains an offer below 19610, initially targets 19525 – 19475 zone.

PVA High Edge = 20024 PVA Low Edge = 19628 Prior POC = 19902

NQ Chart

Trade Strategy: Our tactical trade strategy will simply remain unaltered…We’ll be flexible to trade both long and short side from Decision Pivot Levels. Continue to focus on Bull/Bear Stackers and Premium/Discounts. As always, remaining in alignment with dominant intra-day force increases probabilities of producing winning trades.

Stay Focused…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Trading…David

“Knowing is not enough, We must APPLY. Willing is not enough, We must DO.” –BR

*****This trade strategy report is disseminated for “education only” and should not be viewed in any way as a recommendation to buy or sell futures products.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities. Only risk capital should be used to trade. Trading securities is not suitable for everyone.

Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose.

This website is neither a solicitation nor an offer to Buy/Sell futures, options, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN