Welcome to Polaris Trading Group

Polaris Trading Group (PTG) provides institutional quality comprehensive futures day trading education and training that includes an Online Knowledge Course, Live Trading Room and ongoing Training and Mentoring. Thirty-Nine (39) year veteran trader of Investment Banks and Hedge Funds, David D Dube moderates the PTG Trading Room, where he provides traders specific information and institutional analysis on current market conditions.

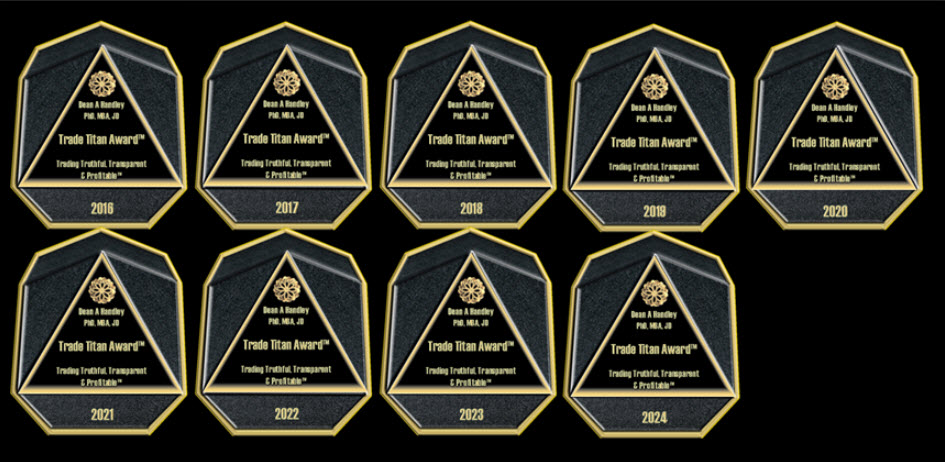

Global Trade Titan Awards!

2016 – 2024

We are excited to announce that Polaris Trading Group (PTG) has received its 9th consecutive Global Trade Titan Award by internationally recognized, Emergent Expert and Trading Consultant Dr. Dean Handley, PhD, MBA, JD.

Dr. Handley has personally evaluated over 2412 trade rooms and has found only Four (4) that meet his strict criteria of Truthfulness, Transparency, and Profitability. He has published over 50 papers in the field of futures trading, best attributes for room selection and methods and strategies to trade futures.

Dr. Handley’s latest PTG Review: “Best ES Futures Trade Sites”

“I am honored to have Polaris Trading Group (PTG) named the 16th Global Trade Titan by Dr. Dean Handley. My Five-Point Mission from Day 1 is listed below…”

“The real benefits accrue to Polaris Members who are dedicated individuals from all walks of life seeking knowledge, to become the very best traders and it is a real gift for me to be able to convey my 42 years of trading knowledge that I learned from Wall Street Investment Banks and Trading Firms.”

Good Trading…PTGDavid

Trading Methodology

Blending Market Profile (Structure), Volume Analysis, Statistical Price Zones (STATX), well defined Trade Setups with specific Entry, Exit, and Price Targets.

Each morning’s Pre-Market Briefing establishes specific actionable demand and supply zones from which to execute various trend or non-trend trade strategies. As the trade session unfolds, Dynamic S&R levels are continuously updated in real-time which keeps our traders in the “now moment”, avoiding pitfalls such as confirmation biases.

Our Mission

- Provide the highest institutional quality trading education and training for our members

- Help traders “unlearn” bad trading habits and form new empowering ones so that they learn to become consistent traders

- Provide professional grade analytical software and institutional trading strategies so the average retail trader can confidently trade along-side the professional “big money” traders

- Demystify market action that enables the uninformed retail trader to become an “informed” trader

- Empower each student to become a self-reliant, confident and consistent trader

Member Benefits

As a member of Polaris Trading Group you will learn the following:

- How to identify and trade from the dominant side of market’s price auction

- Multiple Time-Frame Price Momentum Trade Strategies

- Specific Price and Time Zones upon which to trade

- One specific dynamic price level which acts as an anchor for the entire trading session

- Market Structure: Law of Pivots and Law of Alternate Pivots

- Identifying Signs of Strength and Signs of Weakness

- Four (4) qualities that must be present before a trade is considered

- Specific PTG Trade Setups (Entries and Exits)

- Learn Proper Trade-Risk and Money Management Techniques to Protect Capital

PTG Traders Tool-Box Software Suite

Professional Grade Analytical Indicator Tools that compliments the PTG Trading Methodology. Proprietary Designed Modules such as Balance Chart, Trender, Cycle-Trend, D-Level & Money Box, TargetMaster/X-Zones, Position-Sizing Reward/Risk Algorithm and much more…provides the retail trader with the added “edge“ required to develop into a consistent professional trader.

Thank You for Visiting

I would like to personally thank you for visiting with Polaris Trading Group and would like to extend an invitation to subscribe to the PTG Trading Room. Come visit with us and see how our Methodology can help you improve your trading results.

Good Trading, David

Latest from the PTG Blog

S&P 500 (ES) Prior Session was Cycle Day 3: Positive 3-Day Cycle as price secured a rally above the CD1 Low (6272.50) which has an 90.98% historical performance track history. Positive 3-Day Cycle Statistic is defined as Price Above the … Continue reading

🌅 Opening Context: Bullish Bias with a Target-Lock Mindset The day began with price holding the 6290 Line in the Sand (LIS) in the overnight session, setting the stage for a bullish follow-through into 6305–6310, a precision strike that would … Continue reading

S&P 500 (ES) Prior Session was Cycle Day 2: Wacky Wednesday as what was starting out to be a Normal CD2 with price /balancing/consolidating within the upper target zone, turned into Trump Tape Bomb (TTB) fest. Speculation of a JPOW firing … Continue reading

🧭 Cycle Day 2 Context: MATD Balancing After CD1 weakness and a close near lows, expectations were set for mean-reversion-type action, and the session didn’t disappoint: ✅ Early Bull Bias: Pre-RTH Bull Stacker and textbook D-Level tag set the stage … Continue reading

S&P 500 (ES) Prior Session was Cycle Day 1: Price extended the prior cycle’s rally up to the CD1 Penetration Level near 6340 during the Pre-RTH Session. Cash opening failed to auction higher than the 6325 – 6330 zone outlined in … Continue reading