Janet Yellen Delivers! As expected the word “patient” was removed from policy language, which the market was anticipating an increase in interest rates as early as April – June. The central bank said it would raise rates when it is reasonably confident that low-inflation is on track to return to its 2% target and as long as the job market keeps improving, but offered several reasons it is still in no great rush to walk through.

Markets vaulted an astonishing 47.50 handles in a matter of minutes immediately following release of Fed Decision, and continued to hold bid throughout the remainder of trading session. Never underestimate the Power of the Federal Reserve.

In overnight trade, ES continues to hold bid only 10 handles off yesterday’s high…This continues to be a solid sign of strength, as it appears buyers remain eager to respond on any price dip.

Today is Cycle Day 3 (CD3)…All Cycle Price Targets have been exceeded…Residual momentum may continue into the Pit Session until the buyers are exhausted.

Odds of 3D Rally > 10 = 82% (achieved and exceeded)…Odds of 3D Rally . 20 = 54% (achieved and exceeded); Average Range = 17.75; Max Average Range = 21.50; Possible High = 2108 based upon penetration of CD2 high; Possible Low = 2078 based upon max avg range of CD3.

***Note: The odds highlighted are NOT predictions or trade recommendations, rather a guide based upon historical observed occurrences.

Today’s Hypotheses: June (M) Contract

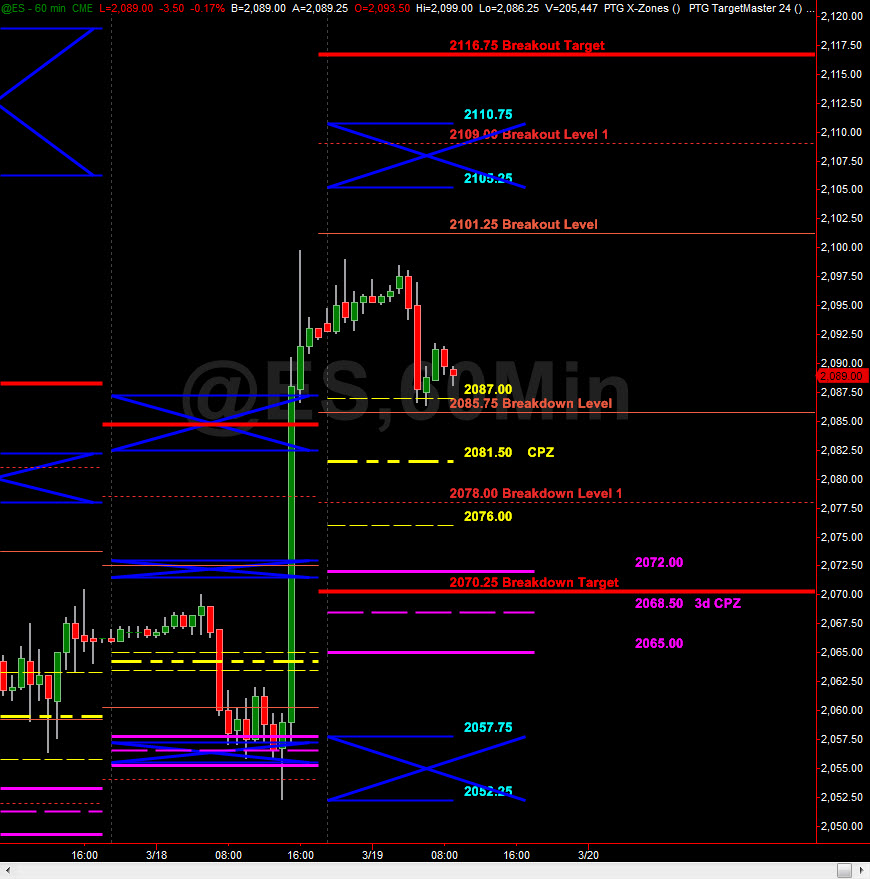

Scenario 1: IF Price can hold at or above 2081.50 on pullback, THEN there is 45% chance of retesting PDH (2099.75). IF this level is cleared and converted, THEN upside extension targets 2105.25 – 2110.75 STATX Zone.

Scenario 2: Failure to convert PDH (2099.75) suggests buyers are exhausted and some consolidation of prior day’s rally is required. Levels to be mindful of on pullbacks are 2086 – 2088 for initial support…Below this zone are layered levels that could illict a buy response…They are: 2081.50 Central Pivot…2078 – 2076, then 2070.25 – 2068.50 3D CPZ.

Trade Strategy: Our tactical trade strategy will simply remain unaltered…We’ll be flexible to trade both long and short side from Decision Pivot Levels. Continue to focus on Bull/Bear Stackers and Premium/Discounts. As always, remaining in alignment with dominant intra-day force increases probabilities of producing winning trades.

Stay Focused…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Trading…David

“Knowing is not enough, We must APPLY. Willing is not enough, We must DO. – Bruce Lee