S&P 500 (ES)

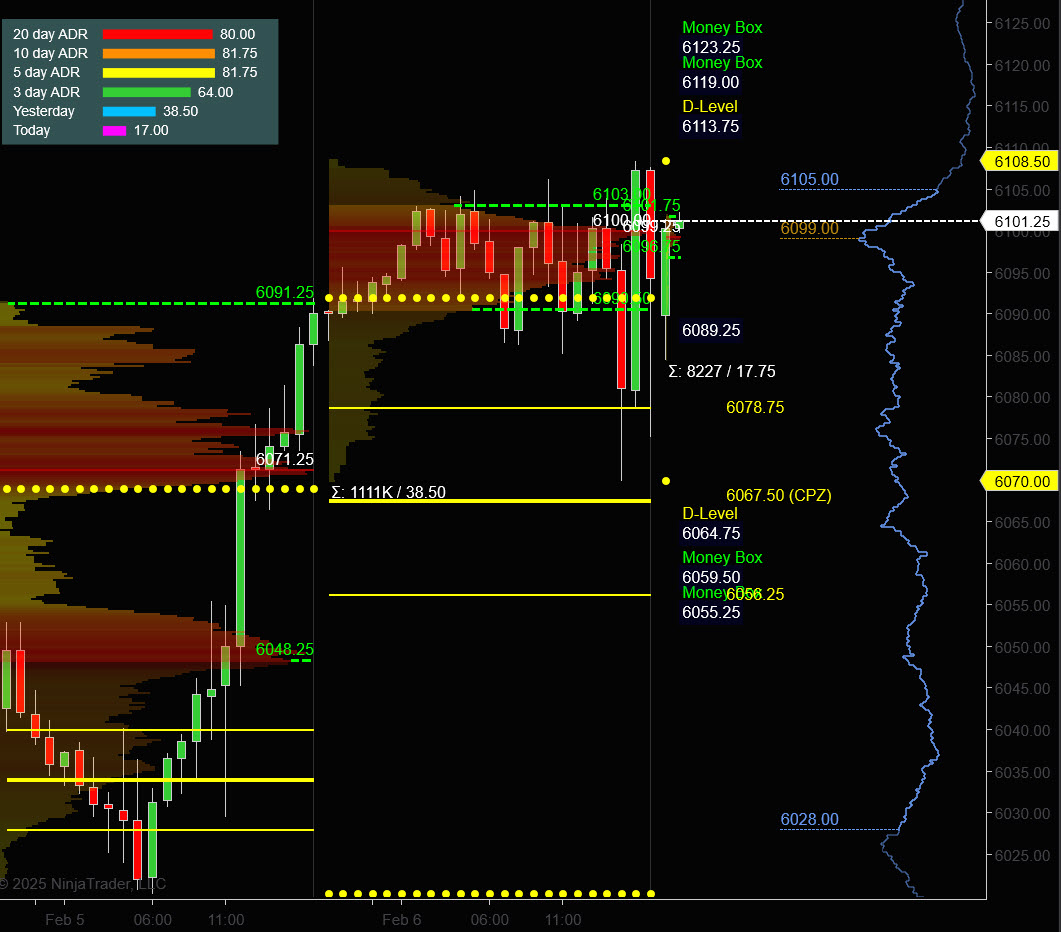

Prior Session was Cycle Day 3: Positive Three-Day Cycle as price rallied 128.5% of the historical 20 cycle average (94.50 pts). Overall this session was a balancing / consolidative day above the key 6085 Line in the Sand (LIS) outlined in prior DTS Briefing 2.6.25. Range for this session was 38 handles on 1.111M contracts exchanged.

FREE TRIAL link to PTG/Taylor Three Day Cycle

For a more detailed recap of the trading session, click on this link: Trading Room RECAP 2.6.25

…Transition from Cycle Day 3 to Cycle Day 1

…Transition from Cycle Day 3 to Cycle Day 1

Transition into Cycle Day 1: This session begins a new cycle with the core objective of establishing a secure low from which to stage the next rally.

Average Decline measures 6072.50 which was tagged during the previous session. Bulls maintain firm control on dips, so should a deeper pullback develop, the next lower objective measures 6047.75.

Odds of Decline > 10 = 79% Odds of Decline > 20 = 56%

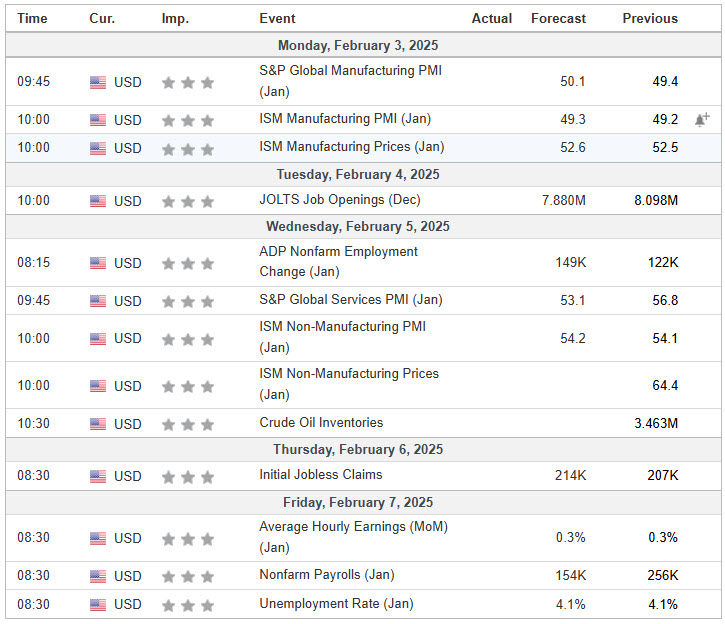

The U.S. Bureau of Labor Statistics is scheduled to release the January 2025 Non-Farm Payroll (NFP) report on Friday, February 7, 2025, at 8:30 AM EST. Economists anticipate an increase of approximately 169,000 to 170,000 jobs for January, following December’s robust gain of 256,000 jobs. The unemployment rate is expected to remain steady at 4.1%.

Average hourly earnings are projected to rise by 0.3% month-over-month, maintaining a year-over-year growth rate of around 3.8% to 4.1%. Analysts will closely monitor wage growth as an indicator of potential inflationary pressures.

The labor force participation rate, which provides insight into the proportion of the working-age population that is employed or actively seeking employment, will also be a key metric to watch.

Additionally, the January report will include annual benchmark revisions, which could lead to significant adjustments in historical employment data. These revisions may alter the understanding of labor market trends over the past year.

Market participants will pay close attention to the NFP report, as deviations from expectations could influence Federal Reserve policy decisions and financial market movements. A stronger-than-expected report might bolster the U.S. dollar and prompt discussions about the timing of future interest rate adjustments, while a weaker report could have the opposite effect.

Of course, nothing changes for PTG…Simply follow your plan. Take only Triple A setups and manage the $risk. ALWAYS HAVE HARD STOP-LOSSES in-place on the exchange.

PTG’s Primary Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 6090+-, initially targets 6115 – 6120 zone.

Bear Scenario: Price sustains an offer below 6090+-, initially targets 6075 – 6070 zone.

PVA High Edge = 6103 PVA Low Edge = 6090 Prior POC = 6100

ES (Profile)

Nasdaq (NQ)

Prior Session was Cycle Day 3: Overall this session was a balancing / consolidative day above the key 21750 Line in the Sand (LIS) outlined in prior DTS Briefing 2.6.25. Range for this session was 176 handles on 436k contracts exchanged.

…Transition from Cycle Day 3 to Cycle Day 1

Transition into Cycle Day 1: This session begins a new cycle with the core objective of establishing a secure low from which to stage the next rally.

Average Decline measures 21756 which was tagged during the previous session. Bulls maintain firm control on dips, so should a deeper pullback develop, the next lower objective measures 21560.

Odds of Decline > 20 = 82% Odds of Decline > 25 = 76%

Of course, nothing changes for PTG…Simply follow your plan. Take only Triple A setups and manage the $risk. ALWAYS HAVE HARD STOP-LOSSES in-place on the exchange.

PTG’s Primary Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 21845+-, initially targets 21895 – 21910 zone.

Bear Scenario: Price sustains an offer below 21845+-, initially targets 21790 – 21760 zone.

PVA High Edge = 21823 PVA Low Edge = 21755 Prior POC = 21773

NQ (Profile)

Economic Calendar

Trade Strategy: Our tactical trade strategy will simply remain unaltered…We’ll be flexible to trade both long and short side from Decision Pivot Levels. Continue to focus on Bull/Bear Stackers and Premium/Discounts. As always, remaining in alignment with dominant intra-day force increases probabilities of producing winning trades.

Stay Focused…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Trading…David

“Knowing is not enough, We must APPLY. Willing is not enough, We must DO.” –BR

*****This trade strategy report is disseminated for “education only” and should not be viewed in any way as a recommendation to buy or sell futures products.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities. Only risk capital should be used to trade. Trading securities is not suitable for everyone.

Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose.

This website is neither a solicitation nor an offer to Buy/Sell futures, options, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN