🔑 Core Market Narrative

-

“Ability to Continue” vs. Prediction: The day opened with a strong mindset reminder—trading success comes from consistency and endurance, not prediction. https://x.com/samuraipips358/status/1911751410053759039

-

Market Environment:

-

Market was in Cycle Day 2 (CD2), typically a MATD Consolidation type, which was confirmed throughout the session.

-

Open Range Reference (5471–5496) acted as key directional zones.

-

Price largely range-bound, oscillating between 5440–5480 for most of the day.

-

🧠 Technical Highlights

-

Initial short plays hit early targets across CL, NQ, and ES.

-

Key Support: The Line in the Sand at 5395 held strongly midday, triggering a buy response and a reversal.

-

VWAP and Prior High were used as references for potential bullish continuation.

-

Reversal Level: The .786 Last Chance Retracement (LCR) held, acting as a turning point late in the session.

-

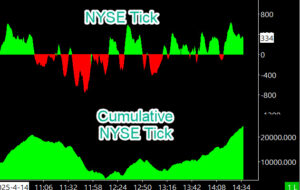

Cumulative NYSE Tick remained positive for most of the day, signaling persistent buying pressure.

-

End-of-Day: MOC Sell Imbalance of $1.2B caused bulls to lose steam, though the LCR zone still delivered a reversal.

🎯 Key Levels

-

Support: 5395 (LIS), 5440, 5450, 5466

-

Resistance: 5475–5490 (Breakdown zone), 5484 (OR Mid)

-

VWAP: A pivotal level throughout for price reaction.

🎤 Tone & Community

-

Friendly and educational with good trader camaraderie.

-

David’s commentary was clear, actionable, and rhythm-based, emphasizing structure, rhythm, and emotional discipline.

📘 Educational Trading Takeaways

-

🔁 Consistency beats prediction: Don’t get caught up trying to forecast every move. Focus on executing your system and adapting to structure.

-

📐 Know your Cycle Day: CD2 typically implies balance; don’t force trend plays where they’re unlikely to play out.

-

🧭 Context matters more than candles: Price action at key zones (LIS, VWAP, Prior High) tells the story—listen to it.

-

🪤 Avoid the trap: Recognizing bull/bear traps, especially around prior session highs or VAH/VAL, can save you from emotional trades.

-

🛑 Sometimes the best trade is no trade: “Can’t get in? Doesn’t mean short it.” Wait for a better setup. Patience is a position.

-

🔄 LCR Reversals: The .786 retracement is a known trap/reversal zone—watch how price behaves here for potential fades or reversals.