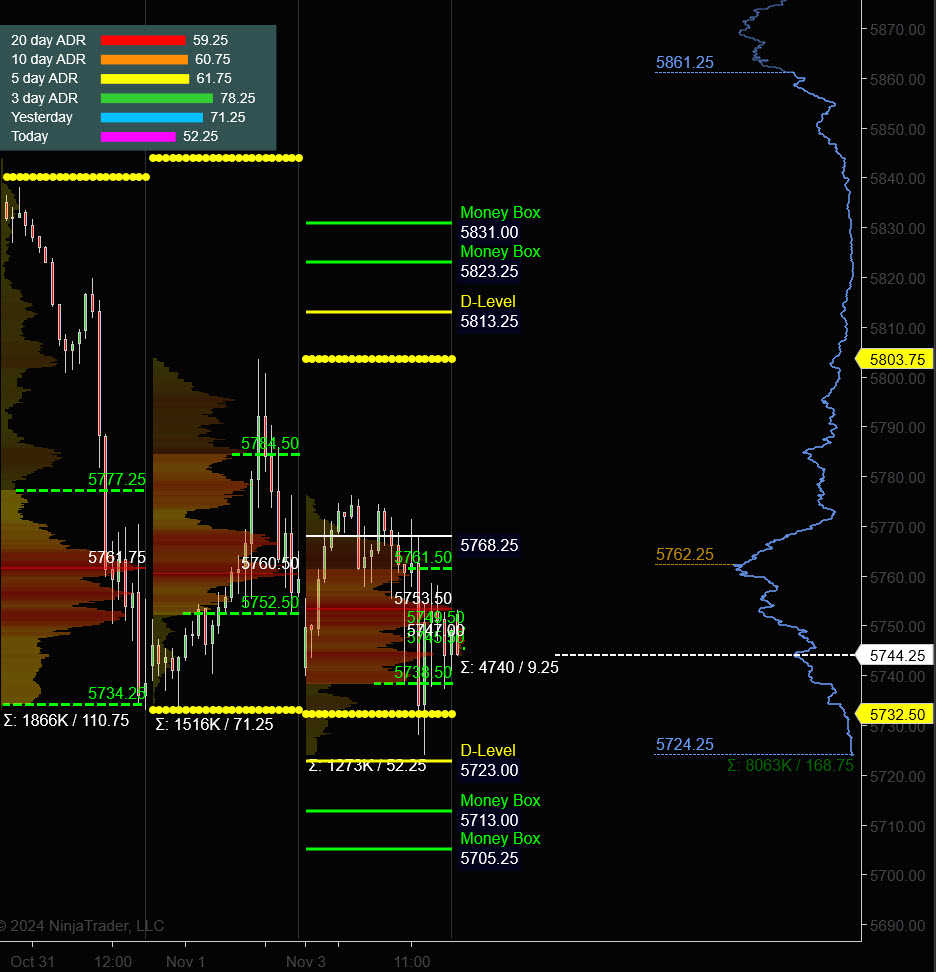

S&P 500

Prior Session was Cycle Day 3: Prior DTS Briefing 11.4.24 unfolded beautifully as price consolidated between the upper target zone (5770 – 5775) and the lower target zone (5735 – 5730). Range was 52 handles on 1.273M contracts exchanged.

For a more detailed recap of the trading session, click on this link: Trading Room RECAP 11.4.24

Check out the link to learn more about the Taylor Cycle and secure your FREE TRIAL.

…Transition from Cycle Day 3 to Cycle Day 1

Transition into Cycle Day 1: The “BIG DAY” has arrived with the markets behaving exceptionally with calmness. Of course this may all change in a moment, but for now it is “business as usual.”

Cycle objective for today is to establish a new cycle low from which to stage the next rally. We’ll continue to pull forward the same levels from prior session. (see above).

***Bulls objective is to continue to absorb any residual selling and Clear and Convert 5770 – 5775 zone to upper support to orchestrate a “squeeze-play!”

***Bears are looking to keep the “pressure-on” by forcing a long liquidation break below current lows.

We’ll continue to remain true to our discipline in maintaining positioning that is aligned with market forces which continues to serve us well, so stay the course.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 5750, initially targets 5770 – 5775 zone.

Bear Scenario: Price sustains an offer below 5750, initially targets 5735 – 5730 zone.

PVA High Edge = 5762 PVA Low Edge = 5738 Prior POC = 5753

ES (Profile)

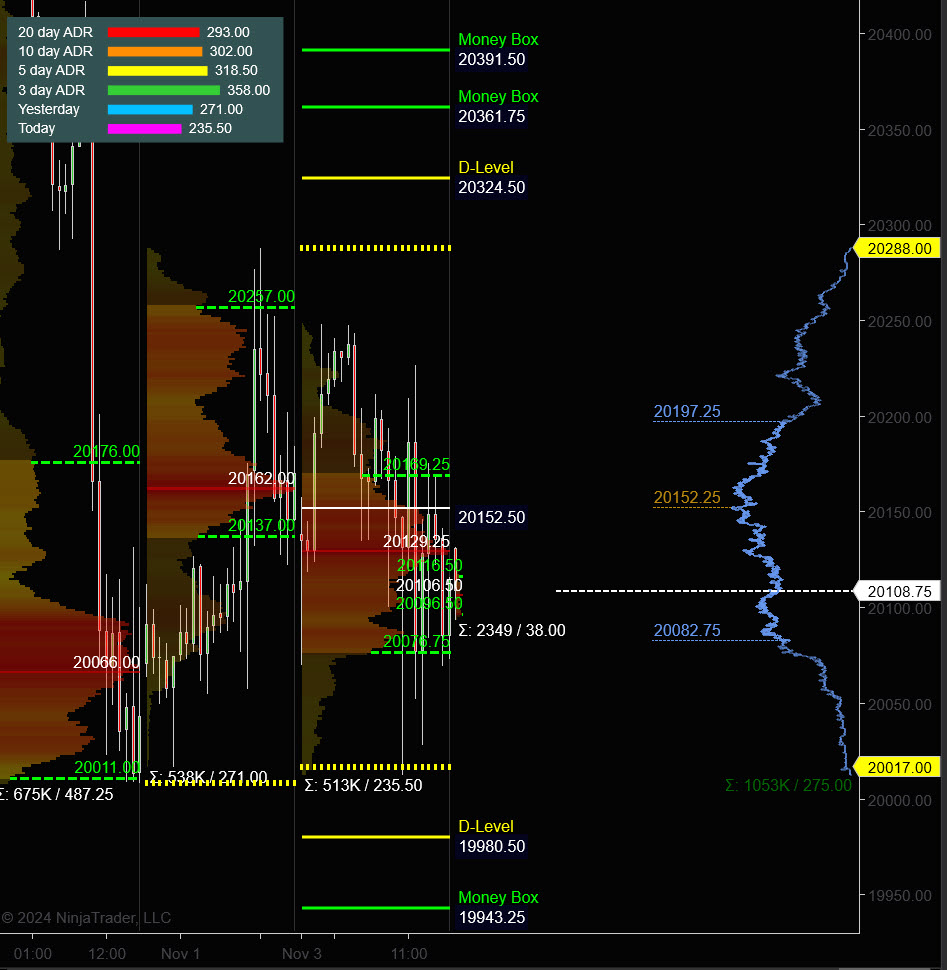

Nasdaq 100 (NQ)

Prior Session was Cycle Day 3: Prior DTS Briefing 11.4.24 unfolded beautifully as price consolidated between the upper target (20200) and the lower target (20000). Range was 235 handles on 513k contracts exchanged.

…Transition from Cycle Day 3 to Cycle Day 1

Transition into Cycle Day 1: The “BIG DAY” has arrived with the markets behaving exceptionally with calmness. Of course this may all change in a moment, but for now it is “business as usual.”

Cycle objective for today is to establish a new cycle low from which to stage the next rally. We’ll continue to pull forward the same levels from prior session. (see above).

***Bulls objective is to continue to absorb any residual selling and Clear and Convert 20200 – 20250 zone to upper support to orchestrate a “squeeze-play!”

***Bears are looking to keep the “pressure-on” by forcing a break below current lows.

We’ll continue to remain true to our discipline in maintaining positioning that is aligned with market forces which continues to serve us well, so stay the course.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 20130, initially targets 20288– 20362 zone.

Bear Scenario: Price sustains an offer below 20130, initially targets 20000 – 19980 zone.

PVA High Edge = 20170 PVA Low Edge = 20076 Prior POC = 20130

NQ Chart (Profile)

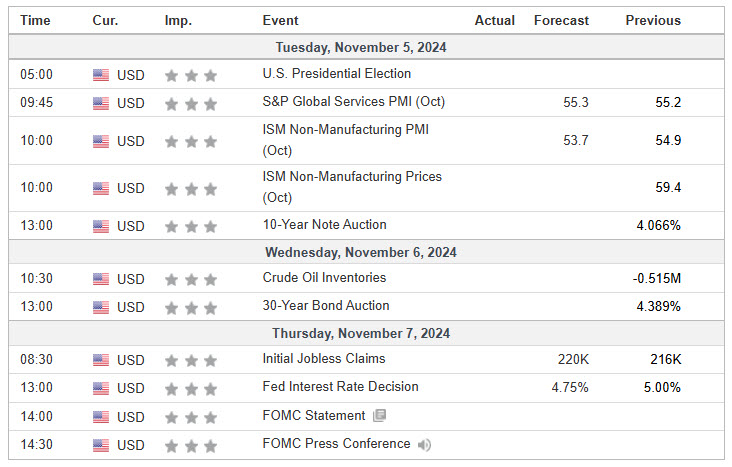

Economic Calendar

Trade Strategy: Our tactical trade strategy will simply remain unaltered…We’ll be flexible to trade both long and short side from Decision Pivot Levels. Continue to focus on Bull/Bear Stackers and Premium/Discounts. As always, remaining in alignment with dominant intra-day force increases probabilities of producing winning trades.

Stay Focused…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Trading…David

“Knowing is not enough, We must APPLY. Willing is not enough, We must DO.” –BR

*****This trade strategy report is disseminated for “education only” and should not be viewed in any way as a recommendation to buy or sell futures products.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities. Only risk capital should be used to trade. Trading securities is not suitable for everyone.

Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose.

This website is neither a solicitation nor an offer to Buy/Sell futures, options, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN