S&P 500 (ES)

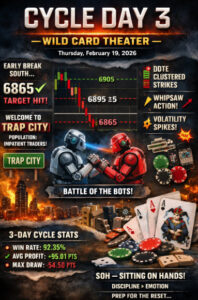

🔥 Cycle Day 3 — Wild Card Theater (Thursday, February 19, 2026)

Three-Day Cycle objective?

✔️ Tagged.

✔️ Bagged.

✔️ Booked.

When a 3-Day Cycle objective completes, we shift from initiative mindset to inventory management mindset. The easy money phase is over. Now comes the Wild-Card — where emotion replaces structure and amateurs donate back what they just earned.

Let’s talk numbers — because numbers don’t care about opinions:

📊 3-Day Cycle Statistics

-

Positive 3 Day Cycle: 92.39%

-

Average Positive 3 Day Cycle: +95.16 points

-

Average Failed (7.65%) 3 Day Cycle: –35.16 points

-

Win/Loss Ratio: 2.71 : 1

-

Maximum Profit: +239.25 points

-

Maximum Drawdown: –54.50 points

-

Average Profit: +76.13 points

This is not random behavior.

This is structural edge.

For greater detail of how this day unfolded, click on the Trading Room RECAP 2.19.26 link.

🔄 Transition: Cycle Day 3 → Cycle Day 1

Reset. Reload. Re-engage.

The board clears… and just like that a fresh Cycle Day 1 steps onto the field.

Edge?

It doesn’t disappear.

It rotates — right back to the traders who understand rhythm over reaction.

Now let’s talk about FRYday.

Traditionally?

Reserved for the bulls.

A late-week squeeze.

A push to pin price near the highs.

A little window dressing before the curtain closes.

But this wasn’t your average sled ride. This week had teeth.

Sellers pressed the gas.

Longs dug in at the lower edge and refused to hand over the keys.

Every bounce earned.

Every dip contested.

And overhead?

Plenty of unfinished business.

Supply still lurking.

Hurdles still standing.

“All clear”?

Not even close.

But here’s the twist…

It’s FRYday. And not just any FRYday — Options Expiration.

Ahhh yes… the monthly chess match.

Gamma games.

Pinning plays.

Dealer defense.

Late-day theatrics.

The kind of tape that rewards discipline…

and punishes ego.

So what’s the play?

Not hero trading.

Not chasing headlines.

Not guessing direction.

It’s what we always preach.

CAPITAL PRESERVATION DAY.

Because the traders who protect capital on Friday

are the ones who get to press advantage on Monday.

Let the games continue.

– PTGDavid

The Two Pillars of the PTG Trade Plan

1️⃣ Stay Aligned with the Dominant Force

Think current, not prediction.

When price structure establishes a support zone, we don’t argue—we align. Bias shifts to a long-lean, and we patiently stalk entries via Stackers or the first PB ATR / Discount.

When structure flips? Same process, opposite direction. No emotion. No hero trades. Just flow.

Picture a surfer:

You don’t fight the wave—you paddle, position, and let gravity do the work.

2️⃣ Trade from Statistical Range Extremes

Welcome to the wabbit hunt 🐇

PKB entries inside the D-Level Money Box (DLMB) Zones live here. And let’s be clear—this is not counter-trend trading. This is timing.

When range values stretch too far, Market Makers don’t chase—they set traps. Stops get flushed. Liquidity gets harvested. Price snaps back like a rubber band.

This is reversionary trading inside range-type rhythms—

high accuracy, repeatable, and ruthless when executed correctly.

Cue the imagery:

Lights dim. Liquidity pools glow. Stops line up like dominos.

M&M’s smile. Click. Run the stops.

The Toolbox Matters—But the Hand Using It Matters More

The PTG Trader Toolbox has everything (yes, even the weird wrench you didn’t know you needed).

Your job isn’t to use everything.

Your job is to master the right tools for your plan.

The PTG Member’s Area is stacked—dozens of educational videos, real trade examples, and market walkthroughs designed to compress learning curves and eliminate guesswork.

And when the chart gets loud?

PTGDavid is always in the room.

Guiding. Grounding. Keeping traders on the right side of structure and statistics.

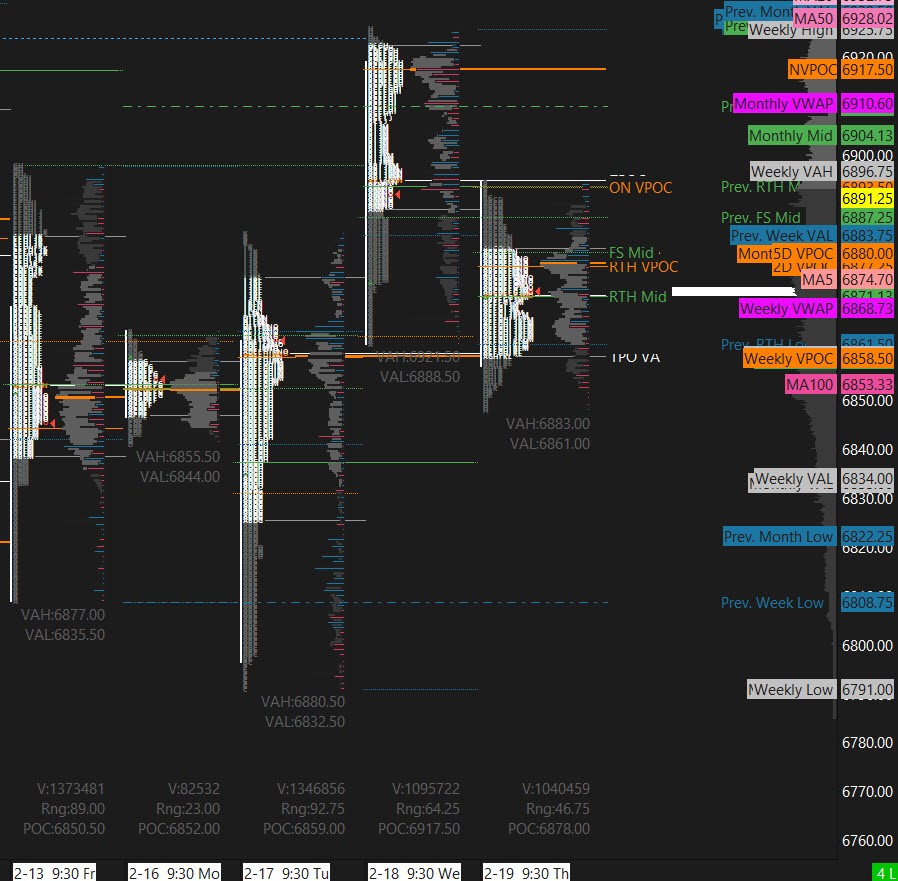

🎯 Cycle Day 1 Focus

Scenarios for today’s trade

🟢 Bull Case — Buyers Stay in Control

Acceptance north of 6895 ±5

Upside objectives:

• 6905

• 6915

• 6925

🔴 Bear Case — Rotation / Reset

Acceptance south of 6895 ±5

Downside objectives:

• 6880

• 6870

• 6860

📊 Key Reference Levels

• PVA High Edge: 6883

• PVA Low Edge: 6861

• Prior POC: 6878

⚠️ Tactical Takeaway

Of course, nothing changes for PTG…Simply follow your plan. Take only Triple A setups and manage the $risk. ALWAYS HAVE HARD STOP-LOSSES in-place on the exchange.

PTG’s Primary Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

ESH

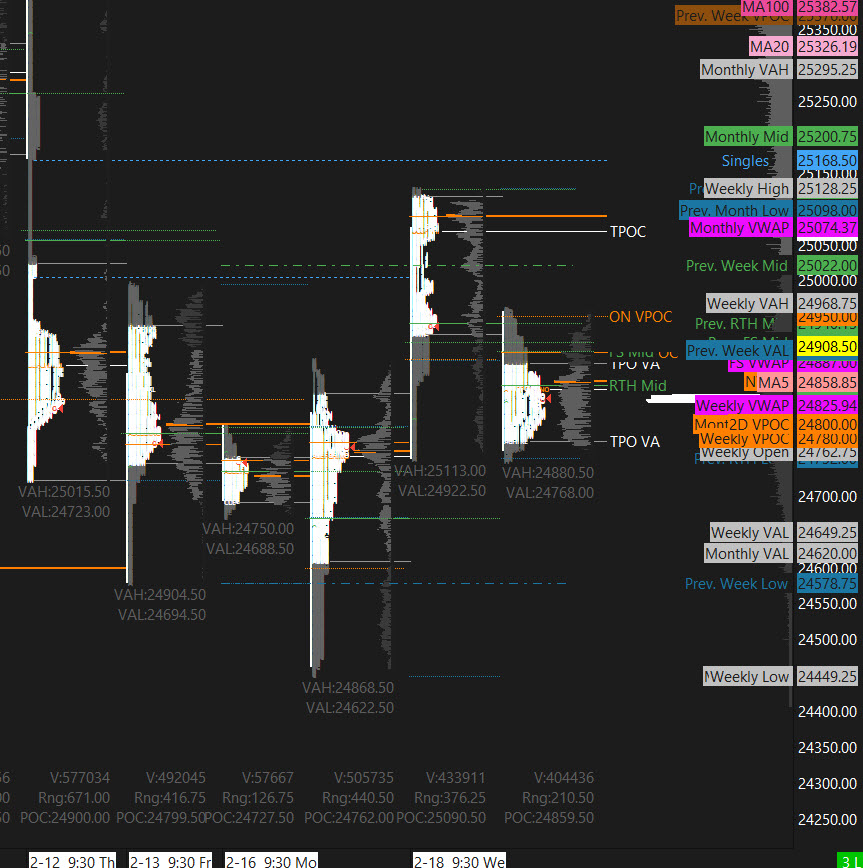

Nasdaq (NQ)

…Transition from Cycle Day 3 to Cycle Day 1

…Transition from Cycle Day 3 to Cycle Day 1

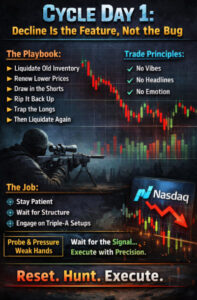

Cycle Day 1: Decline Is the Feature, Not the Bug

Amazing how Mr. Market keeps running the same play… and folks still show up shocked like it’s a plot twist.

Let’s review the script:

Liquidate old inventory.

Renew lower-priced inventory.

Draw in the eager Shorts.

Let them puff their chest out.

Then rip it back up.

Trap the breakout Longs.

Then liquidate again.

Wash. Rinse. Repeat.

This isn’t chaos. It’s inventory transfer. It’s auction theory in a tailored suit.

With the NQ Three-Day Cycle targets fully satisfied, we flip the page and open a fresh Cycle Day 1 in the Nasdaq-100 futures arena. The prior cycle did its job. Boxes checked. Mission complete.

Now we reset the board.

And here’s the part that separates operators from spectators:

We don’t trade vibes.

We don’t trade headlines.

We don’t trade emotion.

We trade cycle dynamics.

Cycle Day 1 isn’t supposed to feel comfortable. It’s supposed to pressure weak inventory. It’s supposed to probe. It’s supposed to shake the tree.

Our job?

-

Stay patient.

-

Wait for structure.

-

Let price advertise opportunity.

-

Engage only when Triple-A setups step forward and raise their hand.

No hand raised?

No trade taken.

A sniper doesn’t fire because he’s bored.

He fires because conditions are met.

Cycle Day 1 is the reset.

Decline isn’t the bug. It’s the feature.

Professionals understand that.

Tourists learn it the expensive way.

🎯 Cycle Day 1 Focus

Scenarios for today’s trade

🟢 Bull Case — Buyers Stay in Control

Acceptance north of 24885 ±10

Upside objectives:

• 24925

• 24950

• 24995

🔴 Bear Case — Rotation / Reset

Acceptance south of 24885 ±10

Downside objectives:

• 24835

• 24795

• 24755

📊 Key Reference Levels

• PVA High Edge: 24880

• PVA Low Edge: 24768

• Prior POC: 24860

⚠️ Tactical Takeaway

Of course, nothing changes for PTG…Simply follow your plan. Take only Triple A setups and manage the $risk. ALWAYS HAVE HARD STOP-LOSSES in-place on the exchange.

PTG’s Primary Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

NQH

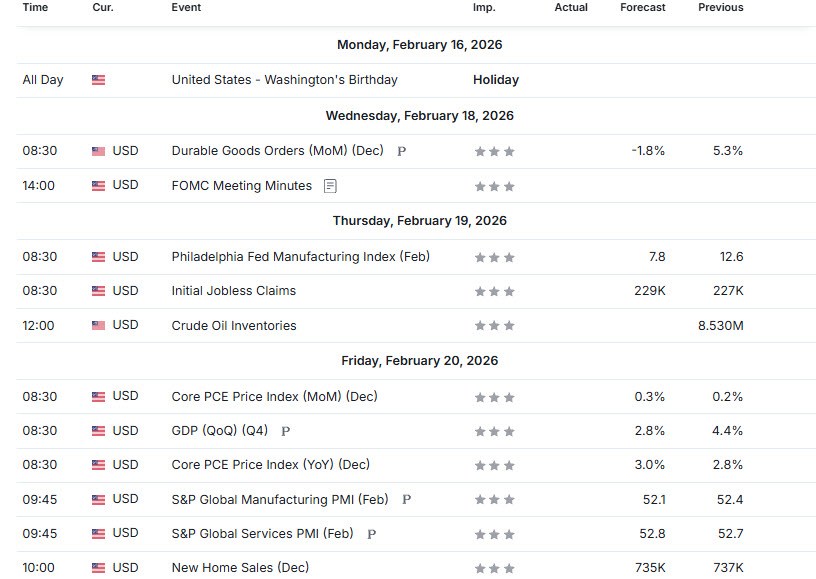

Economic Calendar

Trade Strategy: Our tactical trade strategy will simply remain unaltered…We’ll be flexible to trade both long and short side from Decision Pivot Levels. Continue to focus on Bull/Bear Stackers and Premium/Discounts. As always, remaining in alignment with dominant intra-day force increases probabilities of producing winning trades.

Stay Focused…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Trading…David

“Knowing is not enough, We must APPLY. Willing is not enough, We must DO.” –BR

*****This trade strategy report is disseminated for “education only” and should not be viewed in any way as a recommendation to buy or sell futures products.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities. Only risk capital should be used to trade. Trading securities is not suitable for everyone.

Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose.

This website is neither a solicitation nor an offer to Buy/Sell futures, options, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN