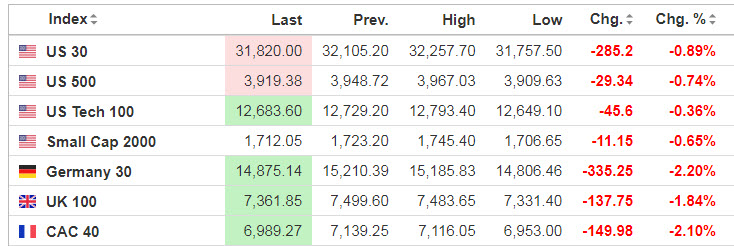

Markets (Top Stories)

“Looking ahead, the longer that financial conditions remain tight, the greater the risk that stresses spread beyond the banking sector, unleashing greater financial and economic damage than we anticipated,” Moody’s wrote in its latest credit conditions report, while fresh trouble rocked Deutsche Bank (DB) in premarket action. A day earlier, Treasury Secretary Janet Yellen said regulators were prepared to take additional actions to ensure Americans’ deposits are safe, after ruling out coverage of all uninsured deposits at U.S. banks. Meanwhile, emergency borrowing under the Fed’s two backstop facilities (Discount Window Lending + Bank Term Funding Program) reached another whopping $163.9B this week, similar to the $164.8B recorded last week (borrowing under the weekly discount window is typically under $10B).

Source: SeekingAlpha.com

Economic Calendar

8:30 Durable Goods

9:30 Fed’s Bullard: U.S. Economy and Monetary Policy

9:45 PMI Composite Flash

1:00 PM Baker-Hughes Rig Count

https://www.investing.com/economic-calendar/

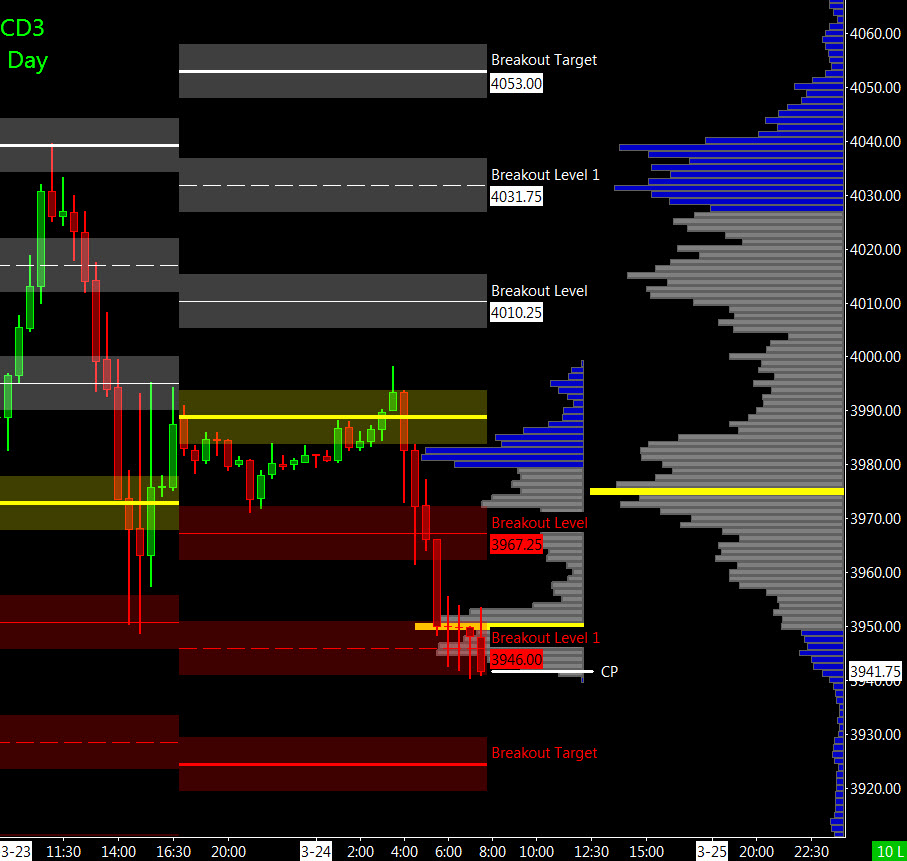

S&P 500

Prior Session was Cycle Day 2 (CD2): Morning rally fulfilled upside targets (TargetMaster / Taylor / Gamma) then sharply reversed, selling down and closing near lows of the session. Prior range was 91 handles on 2.158M contracts exchanged.

…Transition from Cycle Day 2 to Cycle Day 3

This leads us into Cycle Day 3 (CD3): Price is currently below CD1 Low (3966.25) and would need to recover this level to secure a positive cycle statistic. As such, estimated scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 3950, initially targets 3965 – 3970 zone.

Bear Scenario: Price sustains an offer below 3950, initially targets 3935 – 3930 zone.

PVA High Edge = 4015 PVA Low Edge = 3967 Prior POC = 3975

Range Projections and Key Levels (ES) June 2023 (M) Contract

HOD ATR Range Projection: 4035; LOD ATR Range Projection: 3903; 3 Day Central Pivot: 4006; 3 Day Cycle Target: 4052; 10 Day Average True Range 95; VIX: 24

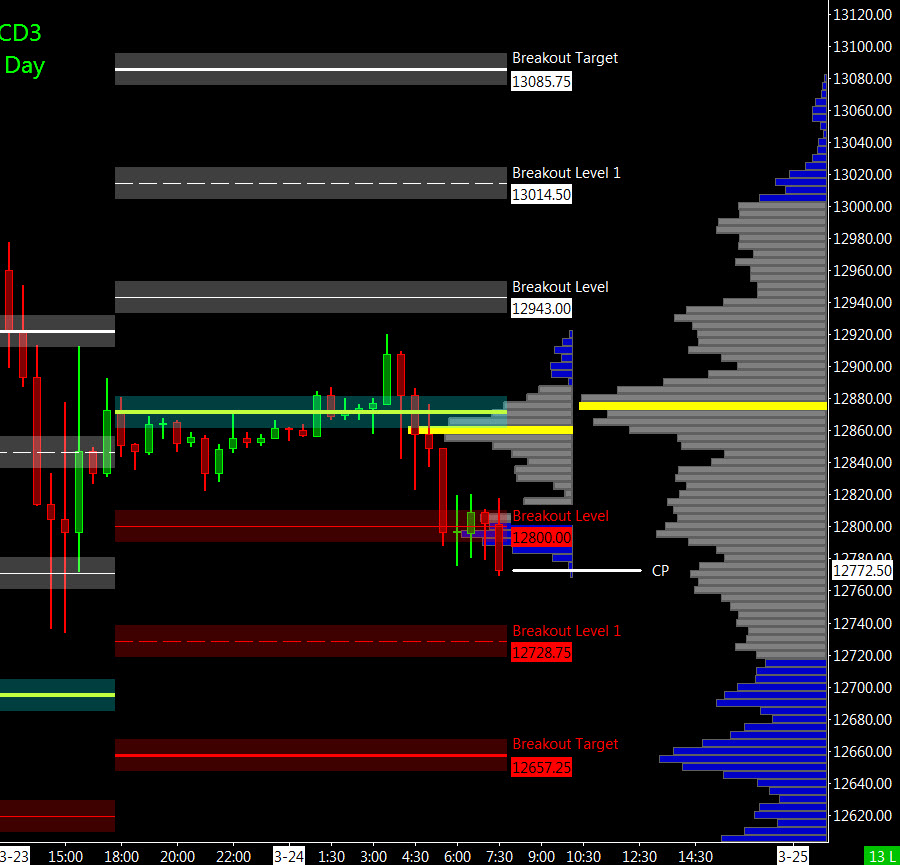

Nasdaq 100 (NQ)

Prior Session was Cycle Day 2 (CD2): Morning rally fulfilled upside targets (TargetMaster / Taylor / Gamma) then sharply reversed, selling down and closing near lows of the session. Prior range was 336 handles on 821k contracts exchanged.

…Transition from Cycle Day 2 to Cycle Day 3

This leads us into Cycle Day 3 (CD3): Price is currently above CD1 Low (12678) and would need to stay above during RTH to secure a positive cycle statistic. As such, estimated scenarios to consider for today’s trading.

Bull Scenario: IF Bulls sustains bid above 12775, THEN initial upside estimate targets 12870– 12875 zone.

Bear Scenario: IF Bears sustains offer below 12775, THEN initial downside estimate targets 12740 – 12720 zone.

PVA High Edge = 12956 PVA Low Edge = 12782 Prior POC = 12832

Range Projections and Key Levels (NQ) June 2023 (M) Contract

HOD ATR Range Projection: 13097; LOD ATR Range Projection: 12597; 3 Day Central Pivot: 12834; 3 Day Cycle Target: 13067; 10 Day Average True Range: 322; VIX: 24

Trade Strategy: Our tactical trade strategy will simply remain unaltered…We’ll be flexible to trade both long and short side from Decision Pivot Levels. Continue to focus on Bull/Bear Stackers and Premium/Discounts. As always, remaining in alignment with dominant intra-day force increases probabilities of producing winning trades.

Stay Focused…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Trading…David

“Knowing is not enough, We must APPLY. Willing is not enough, We must DO.” –Bruce Lee

*****This trade strategy report is disseminated for “education only” and should not be viewed in any way as a recommendation to buy or sell futures products.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities. Only risk capital should be used to trade. Trading securities is not suitable for everyone.

Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose.

This website is neither a solicitation nor an offer to Buy/Sell futures, options, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN