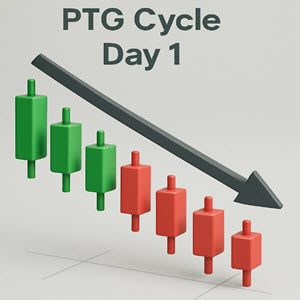

Tuesday delivered a textbook Cycle Day 1 decline, fulfilling the average drop target at 6760 with near surgical precision. The S3H/CD1 setup once again proved reliable, as early structure cues and clock-timing aligned for a clean, probability-driven bearish play.

Tuesday delivered a textbook Cycle Day 1 decline, fulfilling the average drop target at 6760 with near surgical precision. The S3H/CD1 setup once again proved reliable, as early structure cues and clock-timing aligned for a clean, probability-driven bearish play.

The morning session opened firm but quickly revealed the tell-tale S3H pattern — early bid strength failing near the ONH, then a swift rotation lower as sellers absorbed liquidity around the D-Level. Manny and PTGDavid were in full sync, calling the developing PKB Short Structure as the pivotal setup of the day.

⚔️ Session Flow

-

09:15–10:00 AM: Early resilience faded as the market failed to tag the ONH. Manny highlighted the 96% probability stat — either ONH or ONL gets tagged most days.

-

10:00–10:45 AM: Clock window for a high pivot nailed again. Sellers gained control, confirming the bearish tempo as ES broke below 6780 — the “Line in Sand.”

-

10:27 AM onward: The Bears pressed their advantage, driving price toward the CD1 average decline zone (6760).

-

11:10 AM: Precision hit — 6760 achieved. The PTG playbook unfolded to the tick.

-

Midday: Expected balancing and tempo slowdown near the lower range as shorts covered and market gamma provided cushion.

-

Afternoon: 6765 flipped to resistance. Despite intraday rallies, buyers couldn’t reclaim key levels.

-

Close: A $1.2B MOC buy program lifted the tape, but enthusiasm was muted. Price action printed a bearish engulfing candle — Manny’s final note: “Be on alert for a choppy inside day tomorrow.”

🧠 Educational Nuggets

-

“Before the trade” journaling (Yumi Wisdom quote) reinforced PTG’s mantra — process over outcome.

-

Manny’s commentary on tempo recognition (real selling vs. buyable retrace) added another layer to intraday structure reading.

-

Gamma positioning at SPX 6700 anchored the lower bound — a visual lesson in how positioning shapes intraday containment.

🔍 Key Technical Highlights

-

LIS: 6780 (major inflection)

-

CD1 Target: 6760 ✅

-

Next Violation Levels: 6751.25 → 6746.50

-

Resistance Flip: 6765 now acts as a short-term cap

-

SPX Gamma Strike: 6700 remains core magnet

🎯 PTG Summary

A VooDoo-level CD1 execution day — disciplined process, structure adherence, and timing precision.

Bears had the ball early, played their hand methodically, and the tape rewarded those aligned with the statistical rhythm.

Tomorrow’s Outlook:

Watch for inside consolidation or range compression ahead of the next directional cue. CD2 setups often offer rotation potential — stay nimble, trade the structure, not the emotion.