“Rubik’s Cube, Range Rhythms & the Relentless Stacker”

by PTGDavid (feat. Cycle Day 2)

🌅 Pre-Market Prelude – A Tale of Two Targets

The overnight session was an equal-opportunity traveler—hitting both DTS upper (5870) and lower (5830) targets. Like a trader trying to decide between a long espresso and a cold brew, the market said: “Yes.”

From the jump, the pivot level of 5855 was knighted as today’s gatekeeper:

-

Above 5855: Bulls eye the 5870–75 zone

-

Below 5855: Bears claw toward 5830–25

Cue the dramatic music and… enter the Rubik’s Trader’s Cube—PTG’s colorful metaphor for the mental gymnastics of price discovery.

🧠 Mindset Check – Before You Trade, Rubik Your Brain

At 8:28 AM, PTGDavid handed us a philosophical riddle wrapped in a trading plan:

“Decisions: BUY…SELL…Trend…Range…Let’s consult the Rubik’s Trader’s Cube!”

Translation: Don’t just stare at candles—think in structure. Use the context. Get your OODA loop spinning. He then dropped terms like:

-

RSPR Structure (a framework for action)

-

1-min DMI Buy Signals (momentum confirmation)

-

“Shift. Nothing Changes.” (a nod to process discipline)

Trading isn’t about reacting. It’s about preparing—then executing without flinch.

📉📈 Morning Session – A Textbook Dip-and-Rip

Opening action found support at the D-Level—and the bulls wasted no time. By 9:59 AM, the mission was clear:

“Bulls’ objective: Clear and convert 5875 handle to upper support.”

By mid-morning, Cycle Day 2’s classic “two-way rhythms” were fully in play. PTGDavid reminded us to work the Open Range HILO as edges and trade the range with precision, not prediction.

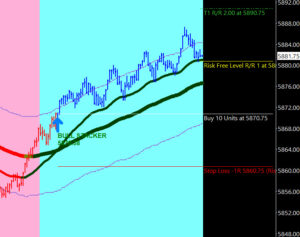

🚂 Midday Momentum – The Stackers Strike

After a brief lunch break (with image proof—yes, he’s human), the afternoon session got spicy.

-

Stacker ignites from 5865s

-

Bid pushes through 5880s, cracks the IBH

-

By 2:00 PM, price presses up against the PUT Wall @ 5891

Momentum was palpable. Comments like:

“Rippin it.”

“Come on, you can do it!”

“Giddy up for the close.”

It was the Stacker Show, and the bulls were the headliners.

🧱 Endgame – The Rug Pull & VWAP Gravity

Just when the bulls started rehearsing for a 5900 breakout party, the close brought a twist:

“Rug Pull on the long for the close…Criminals are @ work”

Ah, the classic Cycle Day 2 fade into mid-VWAP.

Despite a $1.6B MOC buy imbalance, the market closed near equilibrium—a perfect CD2 signature. Two-way action. Edges respected. No home run, but a well-played game for those who stayed aligned.

📚 Educational Takeaway – Structure is Your Strategy

PTGDavid’s day was a masterclass in disciplined context trading. Here’s the real juice:

“You need to devise the HOW.”

It’s not about if you trade—it’s how you prepare, align, and execute inside the market’s rhythm. Whether it’s:

-

Recognizing a Cycle Day type

-

Respecting key pivots like 5855

-

Using tools like Stacker, Trender, DMI, or OR HILO

-

Or just checking the Rubik’s Cube before making a decision…

Your edge is not in the signal. It’s in your structure.

🏁 Final Thought:

If you don’t know your Cycle Day, your Rubik’s Cube will keep showing “no solution.”

So trade the day you’re given, not the move you want. Stack accordingly.