Cycle Day 2: “Gravy Above the Highs”

Thursday, July 24, 2025

Market Overview: CD2 in Full Swing

The day opened with Cycle Day 2 expectations, which usually means one thing: back-and-fill behavior, a breather from the prior trend, and a chance to test key zones.

Add in some fresh tech earnings and a shiny new all-time high, and traders were primed for digestion—both of data and directional bias.

PTGDavid framed the session with clear intent: Primary objectives were already in the bag; anything above would be “gravy.”

Trade Plan & Execution: Clean, Clear, Executed

-

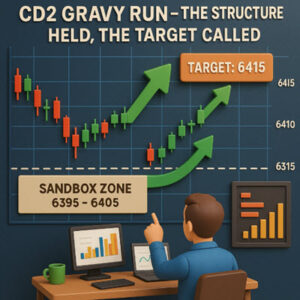

Sandbox Zone: Defined early between 6395–6405, with a bias for continuation only if 6390 held.

-

Bullish Roadmap: Stay above 6390 ➡️ Target 6415–6420.

-

And just like that… the market followed the script. Price hit the 6415 mark late morning, fulfilling the roadmap to a tee.

💡 When the roadmap matches the road traveled—confidence compounds.

Community & Charting: Learning in Lockstep

The PTG crew brought their A-game:

-

Enthusiastic questions around Sierra Chart, volume structures, and bull stackers.

-

PTGDavid shared a Sierra Chart tutorial video, giving traders a solid resource for leveling up.

-

Discussions touched on POC, LVNs, and the layered logic of cross-platform indicators.

Key Lessons & Takeaways

-

✅ Structure Matters: 6390 support and the 6400 POC were mission-critical zones.

-

📊 Planning Pays: CD2 expectations + a sound plan = clean execution.

-

🧠 Tools & Education: Platform proficiency was a major theme—Sierra Chart got plenty of love.

-

🕰 Patience Wins: With the market balanced, discipline mattered more than bravado.

🔗 Links for Reference:

-

🎥 Sierra Chart Video Tutorial (exact link can be plugged in if needed)