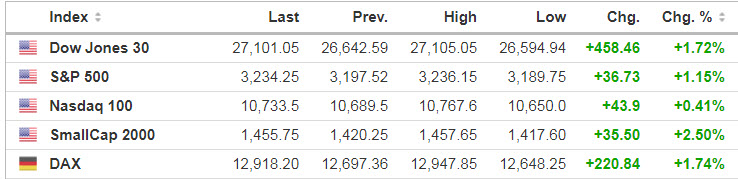

Markets

In the U.S., Dow futures are ahead by 1.3%, with the S&P 500 and Nasdaq up 1.1% and 0.8%, respectively.

Source: SeekingAlpha.com

Economic Calendar

8:30 Empire State Mfg Survey

8:30 Import/Export Prices

9:15 Industrial Production

10:00 Atlanta Fed’s Business Inflation Expectations

10:30 EIA Petroleum Inventories

12:00 PM Fed’s Harker: Economic Outlook

2:00 PM Fed’s Beige Book

https://www.investing.com/economic-calendar/

***New: PTG Trading Room Chat Log’s Link

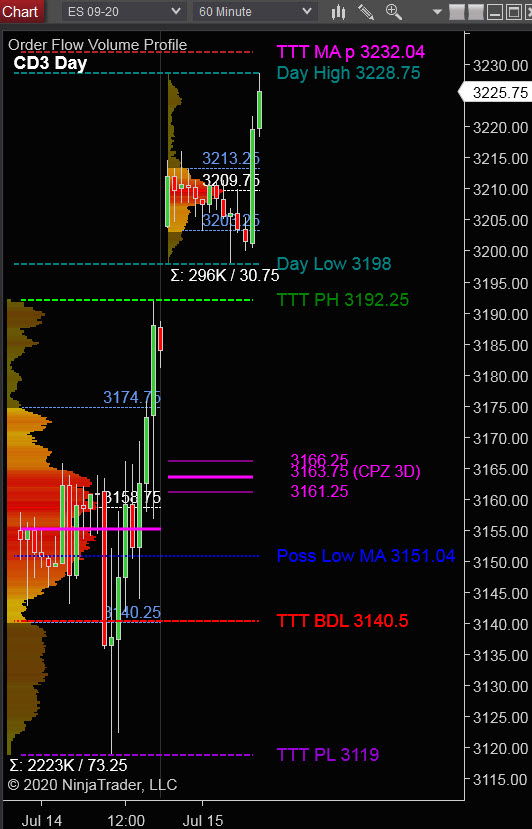

S&P 500

***Written 8 pm Tuesday evening for Wednesday’s trading

Tuesday’s Session was Cycle Day 2 (CD2): Early Violation of Cycle Day 1 Low (3140.50) quickly reversed as buyer’s regained control, holding firm bid all session. Market on Close Buy $2.3 Billion provided final fuel to close price near highs of the day and fulfilling CD2 Average Range of 73 handles.

…Transition from Cycle Day 2 to Cycle Day 3

This leads us into Cycle Day 3 (CD3): Having closed near high of prior session, there remains upside potential to achieve 3212 Cycle Objective (FULFILLED IN GLOBEX). We then have two scenarios to consider for today’s trading.

1.) Price sustains a bid above 3192, initially targeting 3212 – 3217 zone. Additional upside targets measure 3232 – 3239 Penetration Rally Zone.

2.) Price sustains an offer below 3192 initially targeting 3175- 3165 zone.

*****3 Day Cycle has a 91% probability of fulfilling Positive Statistic covering 12 years of recorded tracking history.

PVA High Edge = 3175 PVA Low Edge = 3140 Prior POC = 3158

Range Projections and Key Levels (ES) September 2020 (U) Contract

HOD ATR Range Projection: 3170; LOD ATR Range Projection: 3142; 3 Day Central Pivot: 3165; 3 Day Cycle Target: 3239; 10 Day Average True Range 50; VIX: 28

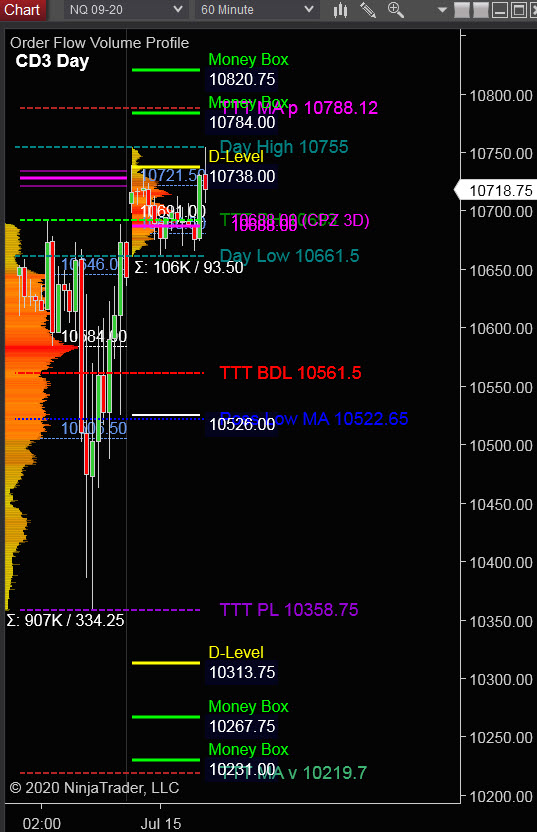

Nasdaq 100 (NQ)

Today is Cycle Day 3 (CD3)…Price is trading above PH (10693) fulfilling D-Level (10738) We have two scenarios to consider for today’s session:

PVA High Edge = 10648 PVA Low Edge = 10504 Prior POC = 10585

Bull Scenario: IF Bulls sustain a bid above 10693, THEN initial upside estimate targets 10738 – 10788 zone.

Bear Scenario: IF Bears sustain an offer below 10693, THEN initial downside estimate targets 10648 – 10585 zone.

Range Projections and Key Levels (NQ) September 2020 (U) Contract

HOD ATR Range Projection: 10574; LOD ATR Range Projection: 10477; 3 Day Central Pivot: 10688; 3 Day Cycle Target: 10885; 10 Day Average True Range: 216; VIX: 28

Trade Strategy: Our tactical trade strategy will simply remain unaltered…We’ll be flexible to trade both long and short side from Decision Pivot Levels. Continue to focus on Bull/Bear Stackers and Premium/Discounts. As always, remaining in alignment with dominant intra-day force increases probabilities of producing winning trades.

Stay Focused…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Trading…David

“Knowing is not enough, We must APPLY. Willing is not enough, We must DO.” –Bruce Lee

*****This trade strategy report is disseminated for “education only” and should not be viewed in any way as a recommendation to buy or sell futures products.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities. Only risk capital should be used to trade. Trading securities is not suitable for everyone.

Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose.

This website is neither a solicitation nor an offer to Buy/Sell futures, options, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN